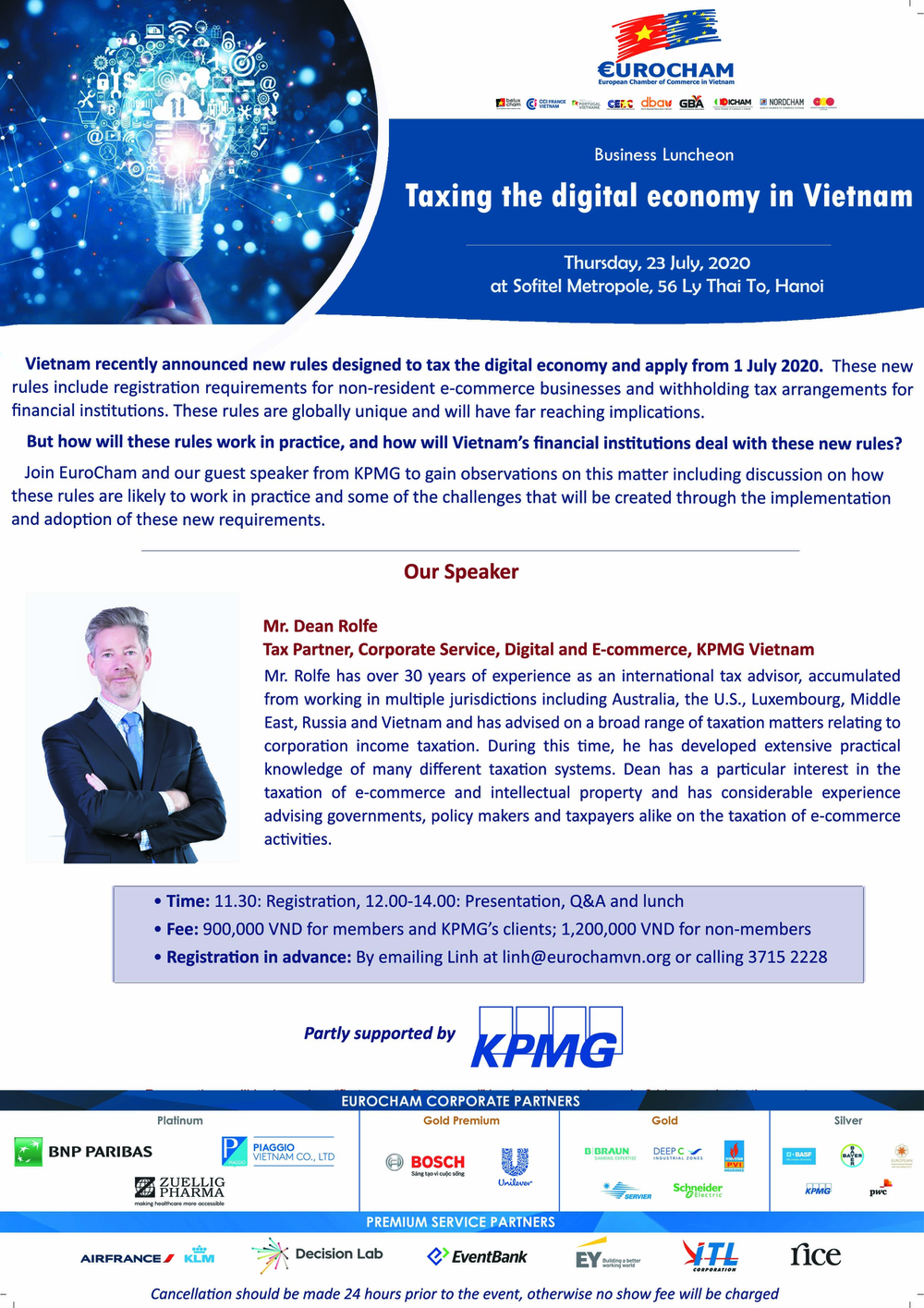

Vietnam recently announced new rules designed to tax the digital economy and apply from 1 July 2020. These new rules include registration requirements for non-resident e-commerce businesses and withholding tax arrangements for financial institutions. These rules are globally unique and will have far reaching implications.

But how will these rules work in practice, and how will Vietnam's financial institutions deal with these new rules?

Join EuroCham and our guest speaker from KPMG to gain some observations on this matter including discussion on how these rules are likely to work in practice and some of the challenges that will be created through the implementation and adoption of these new requirements.

Speakers

Mr. Dean Rolfe

Tax Partner, Corporate Service, Digital and E-commerce at KPMG Vietnam

More Information

Agenda

11

30AM

-

12

00PM

12

00PM

-

2

00PM